ROI stands for “Return on Investment.” It is a financial metric used to measure the profitability or efficiency of an investment relative to its cost. ROI is expressed as a percentage and is a fundamental tool for assessing the success of various investments and comparing their relative performance.

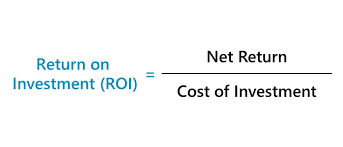

The formula for calculating Return on Investment (ROI) is:

Where:

ROI is a critical metric used by individuals, businesses, and investors to evaluate the success of their investment decisions. A positive ROI indicates that the investment has generated more value or revenue than its initial cost, making it a profitable venture. Conversely, a negative ROI means that the investment has resulted in a loss.

It’s important to consider the timeframe of the investment when interpreting ROI. Short-term investments may yield higher ROI figures, but they may also come with higher risks. Long-term investments may have lower ROI figures, but they can provide stability and consistent returns over time.