Company valuation, also known as business valuation, is the process of determining the monetary worth or fair market value of a company or business entity. It is a crucial exercise for various situations, including mergers and acquisitions, raising capital, selling the business, issuing stock options to employees, and financial reporting.

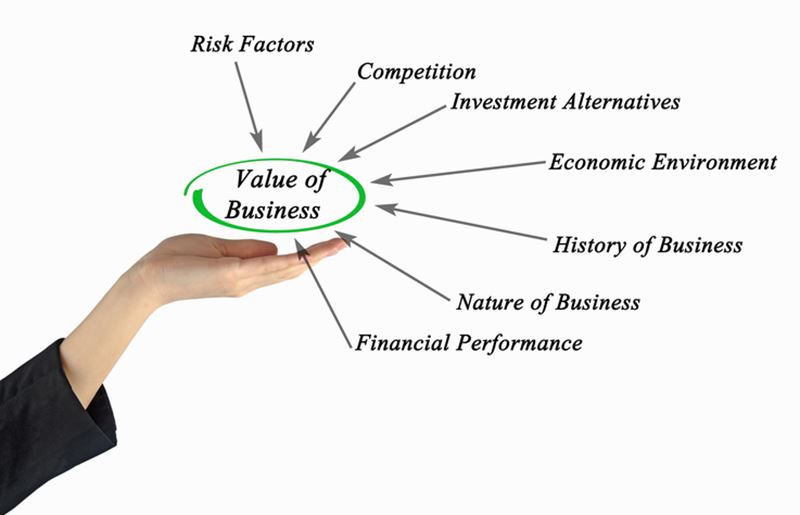

Valuing a company involves assessing its assets, liabilities, earnings, and market position to arrive at a reasonable and justifiable value. There are several methods and approaches used for company valuation, depending on the nature of the business and the purpose of the valuation. Some common valuation methods include:

Market Capitalization: This method values the company based on its current stock price multiplied by the total number of outstanding shares. It is primarily used for publicly traded companies.

Earnings Multiples: The company’s earnings, such as earnings before interest, taxes, depreciation, and amortization (EBITDA) or price-to-earnings (P/E) ratio, are used as a multiple to determine its value. The multiple is often based on industry standards or comparable company analysis.

Discounted Cash Flow (DCF): DCF is a valuation method that involves estimating the future cash flows of the company and discounting them back to present value using a suitable discount rate. It is widely used for private companies and projects with predictable cash flow streams.

Asset-Based Valuation: This approach focuses on the company’s balance sheet, valuing the assets (both tangible and intangible) and subtracting liabilities to arrive at the company’s net asset value.

Comparable Company Analysis: This method involves comparing the company to similar publicly traded companies or recently sold businesses to gauge its relative value.

Venture Capital Method: Used for startups and early-stage companies, this method considers the expected exit value for investors, often based on future funding rounds and expected returns.

Valuations are inherently subjective and can vary based on the assumptions, data, and methods used. It is essential to seek the expertise of professionals such as appraisers, accountants, or financial analysts to conduct a thorough and accurate company valuation. The chosen method depends on the specific circumstances, industry, and the availability of relevant data.